Embarking on a real estate journey comes with a tapestry of intricacies, and among them, closing costs stand as a pivotal piece. In our latest blog, we embark on an enlightening journey to demystify these costs, unraveling their nature and the roles played by responsible parties. Whether you’re a first-time homebuyer or a seasoned investor, understanding these nuances is key to making informed decisions. Let’s delve into the world of closing cost and navigate the path to property ownership with clarity.

Closing costs refer to the additional expenses associated with a real estate transaction in the United States. These costs go beyond the property’s purchase price and are incurred by buyers and sellers. They typically include loan origination fees, discount points, appraisal fees, title searches, title insurance, survey charges, taxes, deed recording fees, and credit report fees.

It is important to note that lenders are legally obligated to provide buyers with a closing disclosure within three business days before the scheduled closing or settlement date.

Closing costs are incurred during the transfer of property title from the seller to the buyer, and their amount can vary depending on the location and property value. Typically, homebuyers are responsible for paying between 3% and 6% of the buying price in closing cost. For instance, on a $300,000 mortgage, the settlement expenses would amount to approximately $9,000 to $18,000.

According to a survey conducted by ClosingCorp, a nationwide firm specializing in these expenses, the average closing costs for a single-family property in 2021 were $6,905, including transfer taxes, and $3,860, excluding taxes. The figures vary by state, with the District of Columbia having the highest closing costs at 3.9% of the sales price, while Missouri had the lowest costs at 0.8%.

Furthermore, under the Federal Real Estate Settlement Procedures Act (RESPA), lenders are required to deliver a comprehensive closing disclosure statement that outlines all the fees associated with the escrow closing costs.

When it comes to closing costs, sellers and buyers have distinct obligations. If you are in the process of selling your house, you may need to cover the following expenses. Typically, these costs are subtracted from the home’s purchase price unless you explicitly request to pay them separately.

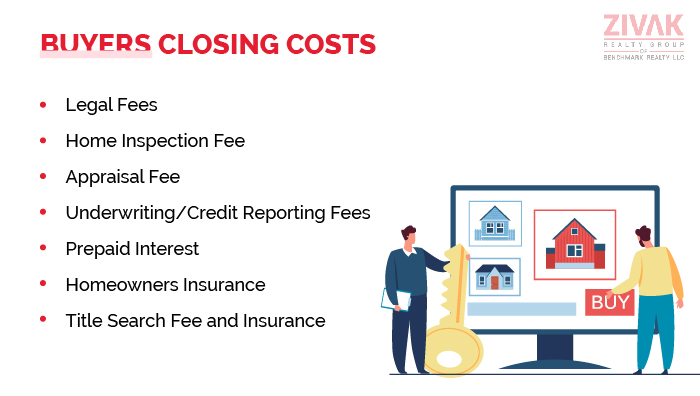

When it comes to closing costs, home buyers are typically responsible for the following expenses, which are generally paid out of pocket during the closing process. Many of these costs are associated with securing a home loan and form part of your overall mortgage expenses.

There are potential opportunities to minimize the overall amount you will pay when it comes to closing costs. Here are a few effective strategies to consider for reducing closing costs:

In summary, home buyers and sellers should anticipate budgeting for closing costs and the down payment when engaging in a real estate transaction. It is common for negotiations to occur between the parties involved to determine who will be responsible for specific costs. Additionally, the chosen loan can impact the overall closing costs, making it essential to shop around and compare mortgage options. Working with experienced real estate brokers in Nashville can help you navigate these financial considerations more effectively and ensure a smoother transaction.

Bo Zivak – Founder of Zivak Realty Group is a real estate professional having expertise in residential and commercial real estate deals in the Greater Nashville Region, Tennessee. With consistent utilization of real estate knowledge and sales experience, Bo Zivak with his team has been dedicated to serving clients and community by offering valuable real estate services.

Stay informed with the latest real estate trends, expert tips, and local market insights from the Zivak Realty Group team—helping you make confident, well-informed decisions.

Franklin vs. Brentwood: Which is the Best Place to Buy a Home?

Franklin vs. Brentwood: Which is the Best Place to Buy a Home?

Nashville, as everybody knows, is a music city and an emerging hub for the real estate market. Nashville, as everybody knows, is a music city and an emerging hub for the real estate market.

Bo Zivak

May 26th, 2025 Luxury Condos in The Gulch, TN: What Buyers Should Know

Luxury Condos in The Gulch, TN: What Buyers Should Know

Situated between Downtown and Music Row, […]

Bo Zivak

May 15th, 2025 Commercial vs. Residential Real Estate: Which Investment is Right for You?

Commercial vs. Residential Real Estate: Which Investment is Right for You?

The Nashville real estate market has […]

Bo Zivak

May 8th, 2025 How Remote Work Is Shaping Real Estate Trends: What Buyers and Sellers Need to Know

How Remote Work Is Shaping Real Estate Trends: What Buyers and Sellers Need to Know

With 32% of Nashville workers remote, […]

Bo Zivak

May 2nd, 2025 Best Places to Invest in Nashville Real Estate: Top Neighborhoods & Strategies

Best Places to Invest in Nashville Real Estate: Top Neighborhoods & Strategies

Did you know? Nashville has become […]

Bo Zivak

April 23rd, 2025 How to Increase Your Home’s Value

How to Increase Your Home’s Value

Looking to boost your home’s value […]

Bo Zivak

April 16th, 2025 Best Places to Buy a House in Nashville, TN: Top Neighborhoods & Suburbs

Best Places to Buy a House in Nashville, TN: Top Neighborhoods & Suburbs

Thinking about buying a home or […]

Bo Zivak

April 10th, 2025 How to Sell A House By Owner in Tennessee: A Step-by-Step Guide

How to Sell A House By Owner in Tennessee: A Step-by-Step Guide

So, you’re considering selling your home without […]

Bo Zivak

April 4th, 2025 Urban Living in The Gulch, TN: A Homebuyer’s Guide

Urban Living in The Gulch, TN: A Homebuyer’s Guide

Did you know? The Gulch is […]

Bo Zivak

March 28th, 2025 Best Golf Course Communities in Brentwood, TN

Best Golf Course Communities in Brentwood, TN

Brentwood, TN, is a fantastic city […]

Bo Zivak

March 20th, 2025Stay in the know—sign up to get exclusive property listings, expert tips, and market updates delivered right to your inbox.

Register now to gain early access to new property listings, save your search preferences, and receive personalized property alerts directly to your inbox. Plus, get exclusive access to detailed market insights and reports to stay ahead in the real estate market.

-