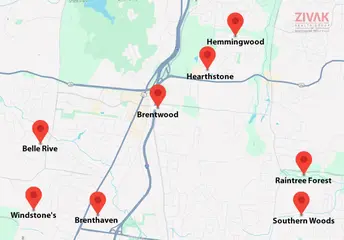

Brentwood Real Estate & Brentwood, TN Homes For Sale

530 results

1012 Berkley Dr

4496

Sq. Ft.4

Beds4

Baths$ 1,300,000

View Detail5108 Herschel Spears Cir

5972

Sq. Ft.5

Beds6

Baths$ 2,000,000

View Detail295 Jones Pkwy

10273

Sq. Ft.6

Beds9

Baths$ 4,750,000

View Detail5560 Hearthstone Ln

2760

Sq. Ft.3

Beds3

Baths$ 995,000

View Detail5107 Longstreet Dr

3262

Sq. Ft.4

Beds3

Baths$ 1,275,000

View Detail9918 Elland Road

4710

Sq. Ft.5

Beds6

Baths$ 1,999,900

View Detail5839 Brentwood Trce

992

Sq. Ft.2

Beds1

Baths$ 299,000

View Detail700 Princeton Hills Dr

7073

Sq. Ft.7

Beds8

Baths$ 3,800,000

View Detail1101 McCall Court

8003

Sq. Ft.6

Beds10

Baths$ 6,324,900

View Detail721 Old Hickory Blvd

3640

Sq. Ft.4

Beds6

Baths$ 1,495,000

View Detail7018 Willowick Dr

4880

Sq. Ft.4

Beds5

Baths$ 1,325,000

View Detail6020 Eastmans Way

7500

Sq. Ft.6

Beds8

Baths$ 6,500,000

View Detail

1012 Berkley Dr

4496

Sq. Ft.4

Beds4

Baths$ 1,300,000

View Detail

5108 Herschel Spears Cir

5972

Sq. Ft.5

Beds6

Baths$ 2,000,000

View Detail

295 Jones Pkwy

10273

Sq. Ft.6

Beds9

Baths$ 4,750,000

View Detail

5560 Hearthstone Ln

2760

Sq. Ft.3

Beds3

Baths$ 995,000

View Detail

5107 Longstreet Dr

3262

Sq. Ft.4

Beds3

Baths$ 1,275,000

View Detail

9918 Elland Road

4710

Sq. Ft.5

Beds6

Baths$ 1,999,900

View Detail

5839 Brentwood Trce

992

Sq. Ft.2

Beds1

Baths$ 299,000

View Detail

700 Princeton Hills Dr

7073

Sq. Ft.7

Beds8

Baths$ 3,800,000

View Detail

1101 McCall Court

8003

Sq. Ft.6

Beds10

Baths$ 6,324,900

View Detail

721 Old Hickory Blvd

3640

Sq. Ft.4

Beds6

Baths$ 1,495,000

View DetailFrequently Asked Questions

We’ve answered some of the most common questions our clients have about buying, selling, and working with Zivak Realty Group.

Didn’t Find What You’re Looking For?

Get in TouchHow do I choose the right real estate agent in Nashville?

Choosing the right real estate agent can be easy when you look in the right direction. Begin by seeking out licensed real estate experts with market knowledge and strong communication skills. Additionally, they must have a proven track record of providing honest guidance to make you feel supported throughout the buying or selling process.

What does a real estate broker do in Nashville, TN?

Real estate brokers help individuals buy their dream home or sell one they’ve outgrown. They are professionals who help individuals undergo the sale and purchase of new homes without the hassle. These real estate brokers can handle pricing, marketing, negotiations, and paperwork. What’s more? Nashville brokers also provide local market insights to ensure customers get the best value.

What’s the current Nashville, TN real estate market like?

Nashville is a growing real estate market. Thanks to its strategic location and growing market, the area has witnessed steady growth over the past years. Moreover, the area has popular neighborhoods with a strong demand for real estate properties, and they spend less time on the real estate market.

What are the benefits of working with a top realtor in Nashville, TN?

Working with a top realtor in Nashville, TN is like working with professionals who understand the market. They possess strong negotiation skills and market insight that enhance the overall buying or selling process. Additionally, these professionals offer personalized services with faster results and access to a rapidly evolving market.

How do I list my home with a Nashville real estate broker?

Listing your home with a Nashville real estate broker is easy. You can start by booking a consultation. Once complete, the broker will assess your home, recommend a suitable price, and create a customized marketing strategy. After signing a listing agreement, your real estate property will be prepared, photographed, and promoted to reach the right buyers.

What makes Zivak Realty Group as one of the top real estate agencies in Nashville?

Years of experience in delivering smiles to customers is what makes us different at Zivak Realty Group. Our real estate experts combine local expertise with a people-first approach, backed by proven results. Our local market expertise enables our customers to navigate the Nashville real estate market seamlessly.

How do I get started with the Zivak Realty Group as the best real estate agent in Nashville?

Getting started is easy; just reach out for a free consultation. Whether you're buying or selling, we'll listen to your needs, walk you through the process, and create a personalized plan to help you succeed in Nashville's market.

What steps should I take to buy a home in Nashville, Tennessee?

There are multiple steps involved when buying a house in Nashville, Tennessee. Start by analyzing your finances to understand how much loan you need. Next, get pre-approved for a mortgage before you start looking for houses. Once done, it’s time to take your agent’s help in locking the house by making an offer, negotiating the terms, and guiding the closing process.

How much do I need for a down payment and closing costs?

Your down payment will be directly proportional to the type of loan. Home buyers are generally required to put between 3% and 20% of the home’s price. Additionally, it’s smart to plan for your closing costs beforehand (typically 2% to 5%). It’s a good idea to get a ballpark estimate early so you’re not caught off guard later.

How do I get pre-approved for a mortgage in Nashville, Tennessee?

Pre-approval begins with completing a loan application and providing documents such as pay stubs, bank statements, and credit information. A lender will review everything and provide you with a pre-approval letter, which demonstrates to sellers that you’re financially ready to buy. It’s one of the smartest moves you can make before touring homes.

What are the best and most affordable neighborhoods in Nashville?

Nashville, Tennessee is a welcoming city with numerous neighborhoods. However, finding the most affordable and best depends on your unique requirements. If you prioritize school districts, areas like Donelson, Madison, and Antioch could be a good option. Similarly, if you're looking for upscale living, consider neighborhoods like Sylvan Park and The Nations. Have other unique requirements? Ensure you pass the message to your real estate agent.

What hidden costs should I plan for when buying a house in Nashville, Tennessee?

Beyond the sale price, there are several standard extras to budget for, including the home inspection, appraisal, property taxes, homeowners' insurance, and possibly some immediate repairs. It’s smart to set aside a little cushion for the unexpected, just in case.

Are there down payment assistance or first-time buyer programs in Tennessee?

Yes, Tennessee has multiple programs for payment assistance and first-time home owners. Programs like THDA (Tennessee Housing Development Agency) and others offer grants or low-interest loans to improve your down payment and closing costs. However, most programs are focused on first-time buyers.

What is a mortgage payment calculator?

A mortgage payment calculator estimates your monthly housing costs based on your loan amount, interest rate, and other factors. It typically includes principal, interest, property taxes, homeowners insurance, PMI, and HOA fees to give a well-rounded monthly estimate.

How accurate is a mortgage payment calculator?

The mortgage payment calculator is highly accurate for principal and interest. However, property taxes, insurance, and PMI vary by location and lender, so results depend on the figures you enter. It’s a helpful estimate, not a guaranteed quote.

What information do I need to use the simple mortgage calculator?

You’ll need the home price, down payment amount, loan term (e.g., 30 years), interest rate, and optional costs like property taxes, insurance, PMI, and HOA fees to get an estimated monthly mortgage payment.

Does this online mortgage calculator include taxes and insurance?

Yes, the online mortgage calculator includes input fields for property taxes and homeowners insurance. Adding these gives you a more complete picture of your monthly housing costs beyond just the mortgage payment.

Can I use this calculator to compare mortgage types?

Absolutely. You can change the loan term, interest rate, or loan type (fixed vs. adjustable) to compare different financing scenarios and see how they affect your monthly mortgage payment.

How can I lower my monthly mortgage payment?

You can reduce your monthly mortgage payment by increasing your down payment, choosing a longer loan term, refinancing to a lower interest rate, lowering insurance premiums, or avoiding PMI if you have at least 20% equity.

Can this mortgage calculator help with refinancing?

Yes. Just enter your current loan balance, new interest rate, and term to compare your current monthly mortgage payment with what you'd pay after refinancing. It’s a great way to evaluate potential savings.

What does PMI mean, and why is it included?

PMI stands for Private Mortgage Insurance. Lenders require it if your down payment is below 20%. It’s added to your monthly mortgage payment, and this mortgage calculator includes it so you get a full cost estimate upfront.

Why should I get a mortgage preapproval in Nashville, TN?

Mortgage pre-approval benefits property purchasers for a variety of reasons in Nashville, Tennessee. It enables buyers to look for houses within their budget, resulting in a simpler and more efficient house hunt. It also makes an offer more appealing to the seller and completes the majority of the financing procedure early on.

Why should I get preapproval from more than one lender?

Applying to numerous lenders allows property buyers in Nashville, TN to compare interest rates and select the transaction with the best conditions. Shopping around for a mortgage that best matches your budget may save you a lot of money throughout the loan.

How long in advance should I get preapproved for a mortgage?

You should apply for a mortgage as soon as you are ready to begin looking for a property. More significantly, you should obtain a mortgage approval as soon as you are financially prepared to purchase a home. Keep in mind that the better your financial state, the more likely you will be authorized.

Can you be refused a mortgage after being pre-approved?

Yes, a buyer's mortgage can be refused even after it has been preapproved. This might be due to an error with the appraisal or the lender's revisions to the guidelines. However, in most circumstances, being refused is due to the buyer's financial situation being badly damaged.

Does having many preapprovals harm your credit score?

When you apply for a mortgage loan pre approval or prequalify for a mortgage loan, a lender does a "hard pull" to verify your credit. This normally reduces your score by a few points. However, according to FICO®, if you make all of your house loan queries within 30 days, your credit score will not be severely affected.

What increases home value the most?

Kitchen and bathroom remodels, energy-efficient upgrades, curb appeal improvements, and added square footage deliver the highest returns. Buyers prioritize updated, functional spaces, especially in competitive markets like Nashville and Franklin.

Which upgrades aren’t worth the money?

Over-personalized designs, luxury add-ons like home theaters, and high-end landscaping often fail to recoup their costs. If it won’t appeal to most buyers or fit your local market, it’s better to skip it.

What’s the cheapest way to increase value?

Fresh paint, modern lighting, updated hardware, and deep cleaning offer strong returns with low investment. Decluttering and neutral décor also help make homes look larger and more inviting.

How much value does a new kitchen add?

A mid-range kitchen remodel can recoup up to 70–80% of its cost. It boosts buyer appeal dramatically, especially when layouts improve function and finishes reflect current trends.

When’s the best time to renovate in Tennessee?

Late winter through early spring is ideal. Contractors are more available, and upgrades are completed before the busy summer market, ensuring your listing stands out to motivated buyers.

DIY vs hiring pros: When to outsource?

Outsource structural, electrical, plumbing, or any job requiring permits. DIY works best for cosmetic fixes like painting or landscaping. Poor workmanship can reduce value or fail inspections, so know when to call a pro.

How can I find out how much my house is worth?

You can use online estimators, but for better accuracy, request a CMA (Comparative Market Analysis) or consult a local Nashville realtor who understands neighborhood trends, home upgrades, and market conditions.

What is a CMA (Comparative Market Analysis) in real estate?

A CMA compares your home to recently sold, similar properties nearby. It evaluates size, condition, features, and location to determine a fair market value and guide your pricing strategy.

Why should I use a local Nashville realtor to estimate my home’s value?

Local agents know micro-market trends, buyer behavior, and neighborhood demand. They offer off-market insights and expert pricing to help sell faster and for the best possible value.

Is the online home value estimator accurate?

Online tools provide rough estimates using public data. However, they often miss home upgrades, condition, and block-level details. A local expert provides more precise, customized valuations.

How do recent home sales affect my home’s value?

Nearby sales called “comps” set pricing benchmarks. Your home’s value is influenced by what similar properties have recently sold for in your area, which realtors include in a CMA report.

How often should I check my home’s value?

Review your home’s value annually, especially before listing, refinancing, or for tax reasons. In fast-moving markets like Nashville, checking every 6–12 months is wise.

What affects my home’s value the most?

Key factors include location, square footage, condition, recent upgrades, curb appeal, and buyer demand. Local market trends and recent sales in your neighborhood also play a significant role.

Can I estimate my house value by address alone?

Your address gives a starting point, but actual value requires a full CMA that accounts for upgrades, condition, layout, and comparable properties in your immediate area.

What’s the average home value in Nashville, TN, right now?

Home values fluctuate often. For an accurate, personalized estimate, request a CMA for your address from a local expert familiar with your neighborhood.

How do I choose the best title company in Nashville, TN?

Look for a company with local expertise, strong reviews, responsive communication, and transparent pricing. The best title companies in Nashville also offer in-house closing services and work closely with your lender or agent.

Can a title company act as a closing agent?

Yes, many title companies in Tennessee also serve as closing agents. They manage escrow, prepare documents, and oversee fund transfers, ensuring the entire transaction is legally compliant and finalized accurately.

What is the role of a real estate closing coordinator?

A closing coordinator ensures all steps of the transaction are completed. They handle timelines, document collection, communication between parties, and troubleshoot issues to guarantee a smooth and timely real estate closing.

Do I need a title company when buying a house in Tennessee?

Yes, Tennessee requires a title company or attorney to verify ownership, perform a title search, and issue title insurance. Their role helps protect buyers and lenders from future legal or financial claims.

Who selects the title or closing agent in Tennessee?

In Tennessee, the buyer typically selects the title or closing company, though this may vary by agreement. It’s essential to choose someone with local experience and a track record of on-time closings.

Are there full-service real estate vendors in Nashville, TN?

Yes, Nashville has several full-service vendors offering everything from title and escrow to closing coordination and mobile signings. These services streamline the process, especially for buyers and sellers managing busy schedules.

What documents are required for a real estate closing?

Standard documents include the deed, closing disclosure, loan documents, title affidavit, and government-issued ID. Sellers may also need a payoff statement. The closing company ensures all paperwork is properly signed and filed.

How do I know when it’s the right time to buy a home?

The right time depends on your financial readiness, market trends, and personal goals. We’ll help you evaluate all three.

How much does it cost to work with a real estate agent?

For buyers, our services are typically free as the seller covers agent fees. Sellers can expect commission costs, which we’ll explain clearly upfront.

How do I get my home ready to sell?

We’ll guide you through staging, repairs, and professional photography to help your home stand out and attract serious buyers.

How much does it cost to work with a real estate agent?

For buyers, our services are typically free as the seller covers agent fees. Sellers can expect commission costs, which we’ll explain clearly upfront.

How do I get my home ready to sell?

We’ll guide you through staging, repairs, and professional photography to help your home stand out and attract serious buyers.

How much does it cost to work with a real estate agent?

For buyers, our services are typically free as the seller covers agent fees. Sellers can expect commission costs, which we’ll explain clearly upfront.

How do I get my home ready to sell?

We’ll guide you through staging, repairs, and professional photography to help your home stand out and attract serious buyers.

How fast can I sell my house in Nashville?

You can typically sell your house in as little as 7 days, depending on your situation. We offer flexible closing dates and offers to help you move on your timeline without delays or complications.

Do I need to make repairs before selling?

No, you don’t need to make any changes. We buy homes as-is, whether they need minor updates or major repairs. Skip the costly renovations, we’ll take care of everything, so you don’t have to lift a finger.

Can I sell my Nashville home if I’m behind on mortgage payments?

Yes. Even if you're behind on payments, you may still be eligible to sell your home quickly. Our team can guide you through options that help you avoid foreclosure and provide a fresh financial start.

What is the process to sell my house fast in Nashville, TN?

It starts with a quick consultation. We’ll assess your home, make a no-obligation offer, and close on your preferred timeline. No listings, no showings, no hassle; just a straightforward way to sell.

What’s the best way to sell your house in Nashville?

The best approach is the one that aligns with your goals. If you want speed, convenience, and no fees, a direct sale is the ideal option. It eliminates agents, showings, and repairs, helping you sell stress-free and on your terms.

Latest Listings & Insights

Planning to buy properties anytime soon? Stay in the loop by signing up for the latest property listings.